The camera module is an important electronic device for image capture. Smart terminals such as smartphones, smart cars, and robots use the camera module to complete optical imaging, enabling functions such as photography, information capture and analysis, and visual interaction. The working principle of the camera module is that the light of the captured object passes through the lens, filters out infrared rays through a filter, and projects the visible light part onto the CMOS image sensor chip. The light signal is converted into an electrical signal through a photodiode, and then the obtained analog signal is converted into a digital signal through an analog-to-digital conversion circuit (A/D) and processed preliminarily before output.

The main raw materials for camera modules are optical lenses, CMOS image sensor chips, voice coil motors, as well as auxiliary raw materials such as infrared filters, bases, passive components, substrates, and soft boards. Camera modules are widely used in industries such as smartphones, smart cars, and IoT. At present, smartphones are the main application market for camera modules, and in the future, smart cars and IoT will be the main incremental markets for camera modules.

Mainly divided into smartphone camera module, car camera module, and IoT camera module

New technology for Qiuti Micro smartphone camera module:

MOB process is different from COB process in that its packaging part is equivalent to the base of the module. This process is connected to the circuit board through molding process to form an integrated structure, and the packaging part wraps the circuit components inside. MOC, on the basis of MOB, is further set inward in the packaging part, wrapping the gold wire inside and connecting it to the chip.

3DSensing technology

Including 3D structured light, iToF, and dToF related technologies, it can meet the important functional needs of downstream customers in areas such as background blurring, shooting distance sensing, and AR motion sensing games. The market is gradually shifting from structured light to ToF solutions in the 3D Sensing field.

Car camera module

Car camera module products are mainly used in DMS and ADAS. At present, ADAS cameras are mainly used for functions such as signal light and sign recognition, pedestrian recognition, active car safety, and assisted navigation driving, while DMS cameras are mainly used for functions such as fatigue analysis, line of sight analysis, and emotion analysis.

IoT camera module

IoT products include visual obstacle avoidance modules, 3D structured light modules, 3DToF modules, and ultra wide angle modules. These products can achieve various functions such as obstacle avoidance, aerial photography, and sensing. Currently applied in fields such as drones, pan tilt cameras, robots, smart watches, etc

With the landing of more 3D application scenarios, 3D structured light modules, 3DToF modules including long band iToF, dToF, etc. are becoming increasingly popular in IoT visual product applications.

The camera module products mainly adopt COB technology including active calibration (AA) process

Development Trends of Camera Modules

(1) The development trend of smartphone cameras

With the increasingly powerful functions of smart phones, consumers can share photos and videos through WeChat, Weibo and other mobile social networks, create content and interact with each other through short video apps such as Tiktok and Kwai, and live broadcast apps such as Tiger Teeth and Douyu. The increasingly diverse and in-depth application scenarios have made smartphones the most closely connected and irreplaceable smart terminal for consumers, while photography has also become a basic need in people's daily lives.

With the increasing diversification of downstream consumers' demands for mobile phone photography functions and the continuous improvement of consumer levels, smartphone cameras are becoming the focus of differentiated competition among major smartphone manufacturers, which also drives the continuous development and innovation of camera technology. In recent years, smartphone cameras have evolved in the directions of pixel upgrades, multi camera, optical stabilization, large aperture, telephoto lens, optical zoom, multi lens design, miniaturized modules, and large-sized pixel modules. Among them, pixel upgrades and multi camera are the main technological update paths. In order to improve imaging quality and meet the shooting needs of different scenes, the pixels of smartphone cameras are constantly increasing and rapidly developing towards multiple cameras.

In addition, periscope cameras and 3D Sensing cameras are also the focus of mobile phone manufacturers. periscope cameras can achieve high magnification optical zoom while maintaining the original thickness of the phone; 3DSensing cameras can restore the three-dimensional features of the real world by recognizing the three-dimensional information of the surrounding environment, thereby achieving advanced application functions such as 3D sensing, AR/VR, etc. The large-sized pixel module helps to increase the amount of light passing through, making the image more delicate. The continuous updates of new technologies in the field of mobile phone cameras have given mobile phone users a new consumption experience.

(2) Diversified product applications

With the development of technologies such as 5G communication and intelligent driving, the level of automotive intelligence is constantly improving; In the field of ADAS, cameras serve as a key entry point for obtaining driving environment image information, with high requirements for reliability and accuracy. They need to be able to distinguish the size and distance of obstacles, recognize pedestrians and traffic signs, etc; In the DMS field, cameras need to capture the driver's fatigue characteristics and determine the driver's level of concentration; In the field of office and leisure, cameras need to achieve functions such as video chatting and taking photos. Cameras have become the core sensors of smart cars, widely used in autonomous driving and intelligent cockpits to meet the driving, entertainment, and office needs of car owners and passengers.

With the development of IoT technology, the cost of IoT products is gradually decreasing, the scenarios are becoming increasingly diverse, and user habits are gradually forming. The market for IoT products such as smart homes and drones is growing rapidly. Through cameras, IoT products can capture more information more clearly, achieving functions such as identifying obstacles, monitoring home environment dynamics, sensing people's fitness dynamics, visual interaction, etc. Cameras are gradually becoming important electronic devices for IoT products such as floor cleaning robots, refrigerators, televisions, and drones.

The development trend of smartphone cameras

The rapid development of smartphone camera technology is completely changing people's daily lives, with constantly innovative functions and optimized convenient experience methods, allowing people to record beautiful moments anytime and anywhere. As a result, the shooting ability of a smartphone has become one of the key factors affecting consumer purchasing decisions.

Against the backdrop of multiple innovative upgrades such as multi camera, high pixel, 3D sensing, optical stabilization, and large aperture, the specifications of smartphone camera modules continue to improve, shipments continue to grow, and the market size expands accordingly. In the era of the stock game of smartphones, with the continuous technological innovation and product iteration of smartphone cameras, the growth rate of the smartphone camera module market will be higher than that of the smartphone market. In recent years, the global market size of smartphone camera modules has continued to grow.

According to TSR statistics, the global market size of smartphone camera modules was 22.375 billion US dollars, 30.593 billion US dollars, and 33.108 billion US dollars in 2018, 2019, and 2020, respectively; In 2019, benefiting from the increase in the proportion of multi camera phones and high specification cameras, the quantity and price of mobile camera modules both increased, and the market growth rate reached 36.73%; In 2020, as the global economy slowed down and smartphone shipments declined, the growth rate of the global smartphone camera module market slowed down to 8.22%. Affected by the increasing penetration rate of multi camera technology, the global shipment volume of smartphone camera modules has been continuously rising in recent years.

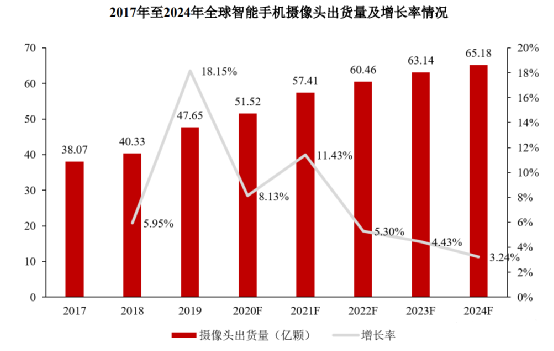

According to TSR statistics, in 2019, multi camera became the mainstream configuration of smartphones. Under the statistical caliber of converting multi camera modules into single camera modules, the growth rate of smartphone camera shipments reached as high as 18.15%; In 2020, the growth rate of smartphone camera shipments slowed down to 8.13%; From 2019 to 2024, the global shipment of smartphone camera modules will increase from 4.765 billion to 6.518 billion, with a compound annual growth rate of 6.47%, maintaining a fast growth rate.

Data source: TSR

With the improvement of mobile phone camera configuration, the price of camera modules has also significantly increased. Based on the estimation of the global market size and shipment volume of mobile phone cameras, the average unit price of mobile phone cameras in 2018, 2019, and 2020 was $5.55, $6.42, and $6.43, respectively.

According to TSR statistics, in the third quarter of 2020, the price of a camera module with a 5-megapixel, 4P lens configuration was around $1.96; A camera module with a configuration of 108 million pixels and a 7P lens costs up to $39.6, which is 20 times the price of the former. At the same time, the packaging price of high-end camera modules has also increased significantly. The packaging price of the former camera module is about $0.35, while the packaging price of the latter camera module reaches $3. High end camera modules have higher requirements for packaging technology, packaging accuracy, and packaging environment, and the product added value of camera modules will also be further increased.

Smartphones are developing from single camera to multi camera, and the shipment volume of camera modules continues to increase

In order to enable smartphones to capture images that are close to professional cameras, achieve high image quality in low light, large portrait aperture, background blur, optical zoom, and other functions, various differentiated multi camera solutions have emerged one after another. The optimization functions implemented by a single mobile phone camera are limited, making it difficult to adapt to changes in lighting and distance in different scenes. By combining multiple cameras, each lens can achieve different functions and meet the shooting needs in different scenes. Taking Huawei Mate40 Pro as an example, the rear camera consists of a 50 megapixel ultra sensing camera, a 20 megapixel ultra wide angle movie camera, a 12 megapixel periscope telephoto lens, and a laser focus sensor; The front camera is a 13 megapixel ultra sensing camera and a 3D depth sensing camera. The ultra sensing camera can capture more details, the ultra wide angle camera can obtain a larger field of view, the periscope telephoto camera supports multiple zoom, and meets the different needs of distant and close range. The 3D depth sensing camera can enhance the stereoscopic effect of the picture, and the laser focusing sensor can accelerate the focusing speed.

The specifications of cameras are constantly improving, and the categories are constantly enriching

The continuous upgrading of mobile phone camera pixels brings clearer and richer photo effects. Meanwhile, the application of innovative technologies such as optical image stabilization, multi fold optical zoom, and 3D sensing in the field of mobile phone cameras has further optimized the user experience for consumers.

The application of technologies such as 3DSensing and periscope cameras

Since the release of Apple's first smartphone with a 3DSensing camera, the iPhone X, in 2017, the 3DSensing camera has solved multiple "pain point application scenarios" and brought consumers a new user experience, such as 3D sensing through capturing facial stereo information, gesture recognition through capturing gesture changes, AR/VR through 3D modeling and various interactive methods, etc. Ordinary 2D cameras can only present scenes in the form of flat images, while 3DSensing cameras can recognize the three-dimensional coordinate information of each point in the field of view, thus presenting a three-dimensional (3D) image. At present, the mainstream technologies of 3DSensing include binocular vision, structured light, and time-oflight (ToF). Binocular vision and structured light are mainly based on the principle of triangulation for distance measurement, while ToF is mainly based on the time-of-flight distance measurement of light.

In 2019, Huawei launched the P30 series with a periscope camera structure. The Huawei P30 Pro achieved 5x optical zoom, 10x hybrid zoom, and 50x maximum digital zoom. Since then, Xiaomi, OPPO, and vivo have successively launched and mass-produced smartphones equipped with periscope cameras. High magnification optical zoom is the main development requirement for smartphone cameras, and periscope cameras can achieve high magnification optical zoom to obtain clearer long-distance shooting effects, becoming the competitive focus of various mobile phone brands. Camera zoom refers to changing the focal length to obtain different widths of field of view, different sizes of images, and different ranges of scenery. The traditional camera module structure has lenses placed parallel to the plane, which is limited by the trend of smartphones becoming thinner and lighter, and cannot meet the requirements of high magnification optical zoom; The periscope lens is placed perpendicular to the plane of the smartphone, and then the prism module is used to reflect the light to the lens and CMOS image sensor chip, thus achieving the coexistence of telephoto lens and lightweight body.

Car camera market

① Cameras have rich application scenarios in the automotive market

In recent years, the integration of new generation technologies such as information and communication, new energy, and new materials with the automotive industry has accelerated, and the intelligent driving and intelligent cockpit industries have developed rapidly. By equipping advanced sensors and utilizing new technologies such as artificial intelligence and 5G communication, cars continue to improve their level of intelligence. Cars not only meet the travel needs of consumers, but also become new places for office and entertainment.

Both intelligent driving and intelligent cockpit require the use of onboard cameras. Car mounted cameras can be used to capture visual images with high resolution and temperature adaptability. They can distinguish the size and distance of obstacles, recognize pedestrians, traffic signs, and lane markings, monitor the driver's driving status, and provide in car video chat functionality. According to the different installation positions in cars, camera modules are divided into rear view, front view, side view, interior view, surround view, etc.

A. The development of intelligent driving technology and the increasing demand for camera modules

Intelligent driving generally refers to concepts such as assisted driving, advanced driver assistance systems (ADAS), autonomous driving in limited scenarios, and completely autonomous driving that deviates from human drivers. According to the J3016 released by the Society of Automotive Engineers (SAE International), autonomous driving technology is divided into six levels, from non driving automation (level 0) to fully driving automation (level 5):

Intelligent driving technology can compensate for the insufficient decision-making and operational abilities of drivers, prevent or reduce traffic accidents and losses, and reduce the labor intensity of drivers. Sensors, as important tools in automotive perception systems, can monitor the driving environment and vehicle status, and are the foundation for achieving intelligent driving. Vehicle mounted sensors mainly include cameras, radar, and LiDAR, which are used to obtain information such as traffic signs, obstacles, distance, speed, etc. They are the "eyes" of cars. Automobiles enhance their autonomous driving capabilities by increasing the number and types of sensors, and integrating multiple sensors together.

At present, most automobile manufacturers have chosen a technical solution combining multiple types of sensors. Taking the L2 level autonomous vehicle Tesla Autopilot as an example, the vehicle is equipped with eight high-definition cameras surrounding the body, with a field of vision of 360 degrees and a maximum distance of 250 meters for monitoring the surrounding environment; 1 front radar with a detection range of 160m; 12 ultrasonic sensors with a monitoring distance of 8 meters.

With the gradual increase in sales of L1 and L2 level cars, as well as the commercialization of future high-level autonomous driving technology L3-L5 cars, the demand for in car cameras will significantly increase. According to Yole data, the production of camera units for automotive applications in 2018 was 124 million, slightly higher than the production of 96 million light vehicles in the same year. The average number of cameras installed per vehicle is 1.3. With the application and development of autonomous driving technology, the average number of cameras installed per vehicle will increase to 3 by 2024.

In the automatic driving phase, the safety of passengers' life and property depends on the judgment of the auto drive system. The on-board camera, as the core sensor for collecting visual data, is a functional safety component of the auto drive system. Once the performance of the camera goes wrong and the data is not collected accurately and timely, the auto drive system will make a false judgment. Therefore, downstream automobile manufacturers put forward strict standards for the reliability and service life of on-board cameras, requiring that cameras can operate reliably in extremely cold, hot and humid environments and still provide high-quality image data in low illumination and high dynamic scenes, including pedestrians, cars, obstacles, traffic signs, traffic lights, lanes, etc., for analysis and decision-making of the auto drive system. As a key sensor for smart cars, the main raw materials and product development costs of in car camera modules are high, and the requirements for performance and reliability are very strict. Its price is significantly higher than that of mobile phone camera modules.

According to Yole's prediction, in 2020, the global ADAS market size will be $8.6 billion, with radar, camera module, and LiDAR markets of $3.8 billion, $3.5 billion, and $0.4 billion, respectively; By 2025, the global ADAS market is expected to grow to $22.4 billion, with a compound annual growth rate of 21%. The radar, camera module, and LiDAR markets are expected to reach $9.1 billion, $8.1 billion, and $1.7 billion, respectively, with growth rates of 19%, 18%, and 22%, respectively.

B. Intelligent cockpit meets leisure and entertainment needs

The trends of connectivity, automation, and sharing are changing the automotive industry, and consumers' demand for cars is shifting from "transportation" to an important "third space" outside of home and office, with the cockpit being the core carrier for constructing space.

As a tool for capturing images, in addition to being used in driver monitoring systems (DMS) to assist driving, in car cameras can also enhance ride comfort, vehicle safety, and meet consumer work and entertainment needs. The in car camera can recognize the user's identity, and the system adjusts the seat, temperature, and rearview mirror to the appropriate state based on the data; Record evidence of vehicle damage or loss; Provide video conferencing and chat functions.

According to Yole's prediction, the size of the in car application market will be 13.1 billion US dollars in 2020, and will exceed 22 billion US dollars by 2025. Among them, the size of the sensor market will significantly increase, growing from 300 million US dollars in 2020 to 2.6 billion US dollars by 2025, with a compound annual growth rate of 63%.

② The market size of car cameras is vast and the growth rate is fast

According to the latest report released by ICVTank in December 2021, the global average vehicle configuration in 2021 was 2.3 cameras, a significant increase from 2020. It is expected that by 2026, the number will reach 3.8 cameras per unit. The global car camera market includes front-end assembly (completed by the vehicle manufacturer) and back-end assembly (assembled after the vehicle is shipped). In 2021, the global car camera front-end market reached 12.2 billion US dollars, and the back-end market reached 5.1 billion US dollars. In the future, as the penetration rate of smart cars gradually increases, cameras will be installed at the factory stage, and the proportion of the aftermarket will gradually decrease. From 2020 to 2026, the global market size for autonomous driving cameras is expected to grow from $13.1 billion to $35.5 billion, with an average annual compound growth rate of 18.08%, indicating rapid growth.

According to the ICVTank report, the front-end market is the most important market for car camera modules. From 2020 to 2026, the shipment quantity of front-end car cameras will increase from 100 million to 370 million, with an average annual compound growth rate of 24.32%, showing rapid growth.

③ Global car camera module manufacturers mainly consist of European and American companies

According to Xuri Big Data, the top three Tier 1 car camera module companies in the world are Continental Automotive from Germany, MAGNA from Canada, and Valeo from France. The top three companies dominate the global car camera module market. Continental Automotive, MAGNA, and Valeo were established in 1871, 1955, and 1961, respectively, and have been in operation for over half a century. Currently, there is no comparable car camera module enterprise in China.

The world's leading companies in car camera modules all originated from the era of internal combustion engines and have established deep cooperative relationships with mainstream traditional gasoline car manufacturers such as BMW, Mercedes Benz, Audi, etc. In recent years, new energy vehicles have developed rapidly, and the competitive landscape of the global automotive market has gradually changed. Chinese new energy vehicle companies represented by Xiaopeng, BYD, NIO, Ideal, and BAIC New Energy have risen rapidly. With the changes in the competitive landscape of downstream vehicle manufacturers and the increase in the proportion of Chinese enterprises, the competitive landscape of the global car camera module market may undergo certain changes, and emerging car camera module enterprises in China have the opportunity and possibility to overtake on the bend.

④ Car camera module has higher product added value

Downstream automobile manufacturers put forward strict standards for the reliability and service life of on-board cameras (at least 8-10 years to match the service life of vehicles), requiring cameras to operate reliably in extremely cold (-40 ℃), hot (85 ℃) and humid environments, and still provide high-quality image data in low illumination and high dynamic scenes, including pedestrians, cars, obstacles, traffic signs, traffic lights, lanes, etc., for analysis and decision-making of the auto drive system; In addition, due to the generation of extremely high electromagnetic pulses when the vehicle is started, the onboard camera also needs to have anti magnetic performance.

As a key sensor for smart cars, in car cameras have higher safety standards, higher costs for main raw materials and product development, higher production technology requirements, greater process difficulty, and higher product added value. With the large-scale shipment of car camera module products and further improvement of production processes, the profit margin of emerging car camera module manufacturers will also increase.

IoT Market

IoT has established a pathway from the physical world to the virtual world and dataization, known as the fourth technological revolution. IoT connects different users and terminals through various IoT connection protocols, forming a connection between people and things, and between things, making people's lives more convenient. According to the 2021 Global AIoT Developer Ecology White Paper published by Gartner and other institutions, smart hardware has evolved from the 1.0 stage of ubiquitous connectivity (device networking) to the 2.0 stage of ubiquitous connectivity (different devices can be connected to each other), and all the way to the current stage of ubiquitous intelligence 3.0. Smart hardware can actively detect users' preferences and habits, providing the most suitable usage scenarios for users' needs. According to IDC data, the global Internet of Things connectivity is expected to reach nearly 65 billion units by 2024, which is 11.4 times the number of mobile phone connections; The global IoT market size was 686 billion US dollars in 2019, and by 2022, the market size is expected to exceed trillions of US dollars.

Under the trend of global virtual reality integration, AR/VR, as the core terminal device for achieving immersive interaction, has mature conditions for combining with gaming and entertainment content, and the AR/VR market has enormous development potential. According to statistics from IDC and other institutions, the global virtual reality market reached nearly 100 billion in 2020, with a VR market of 62 billion and an AR market of 28 billion. According to Counterpoint's forecast, global AR/VR device shipments will grow from 11 million units in 2021 to 105 million units in 2025, with market demand gradually expanding.

The camera is the core sensor of VR/AR devices, which realizes various functions such as head positioning, motion tracking, video shooting, and environment acquisition. According to Qualcomm's statistics, as of November 17, 2021, the sales of VR product Oculus Quest 2 have reached 10 million units. Oculus Quest 2 is equipped with 4 cameras, which are used to track head and hand movements and display gray and white perspective images. The product supports up to 7 cameras in operation.

At the SPIE (International Society for Optical Engineering) conference in January 2022, Magiceap released Magiceap2, which is equipped with four eye tracking cameras (monocular x2) and five sensors for depth and perception calculations (including a 12M pixel autofocus RGB camera). There are many application scenarios for IoT, such as smart homes such as smart refrigerators, smart air conditioners, and floor cleaning robots, smart security products such as surveillance cameras and smart door locks, and smart robot products such as medical robots and drones.

The camera module is an important electronic device for IoT devices to obtain effective information, mainly used in fields such as machine vision and high-definition video. In the era of the Internet of Everything, cameras capture and record images and videos, and realize remote monitoring, real-time observation, etc. through the Internet. With the progress of deep learning and artificial intelligence (AI) technology, AI devices with cameras can obtain more useful information and data from their images, thus realizing visual interaction, obstacle recognition, human shape detection and other functions.

Traditional household appliances are gradually realizing remote control, intelligent interaction and other functions through network connections. Visual and sensory interaction will become an emerging growth point after voice in the application of smart home devices, and smart home devices will further develop towards multimodal interaction. Taking the Ecovacs DEEBOT 8AIVI robotic vacuum cleaner as an example, it is equipped with a visual recognition system with a wide-angle camera, which can obtain and analyze obstacle data in the environment, conduct targeted safety inspections, and safeguard home safety. Visual sensing interaction technology has improved the efficiency of smart home devices. According to IDC's prediction, 24% of smart home devices will be equipped with visual or sensing interaction functions in 2021. By 2024, the market size of smart home devices will exceed 80 billion US dollars.

Robots and drones are important application markets for cameras. Cameras are important sensors for robots and drones to collect data, and can also meet the needs of photography and videography. Taking the DJI MavicAir2 drone as an example, the visual system is equipped with front, rear, and bottom view cameras. The main camera can take 48 million pixel photos and capture 60 frames per second (4K/60fps video) at 4K resolution.

According to IDC statistics, the global market size for robots and drones was $109.85 billion in 2019. From 2019 to 2024, the global market is expected to achieve a compound annual growth rate of 20.1%, and it is projected that the market size will reach $274.62 billion by 2024. China is the world's largest market for robots (including drones), expected to account for 38% of the global total in 2020, with a total expenditure of 47.38 billion US dollars. By 2024, it will account for 44% of the global market and reach a scale of 121.12 billion US dollars.

The rapid rise of China's camera module industry chain

With the rapid development of the Chinese economy, China has become the world's largest consumer electronics market, and camera modules, as the main sensors for mobile phones and other consumer electronics, have ushered in opportunities for rapid growth. As of the end of 2020, the top three suppliers of mobile phone camera modules globally were OFILM, Sunny Optics, and Qiu Tiwei, all of which were Chinese companies. The camera module serves as the core sensor for intelligent terminals such as automotive electronics and IoT. The huge market demand in the domestic intelligent automotive and IoT fields will further drive the rapid development and iteration of camera modules, accelerate the technological and process innovation of camera modules, and promote the rapid rise of the domestic camera module industry chain.

The trend of domestication of upstream raw materials is gradually strengthening

In the main raw material industries such as CMOS image sensor chips, optical lenses, and voice coil motors for camera modules, the market share of domestic manufacturers is gradually increasing, and the trend of localization is evident. High end CMOS image sensor chips are still dominated by Japanese and Korean manufacturers, but the gap between domestic manufacturers represented by Huawei Technologies and Geko Microelectronics and Japanese and Korean manufacturers is gradually narrowing. Huawei Technologies has achieved mass production of 64 million pixel CMOS image sensor chips, while Geko Microelectronics occupies an important position in the market of 13 million pixel and below CMOS image sensor chips.

In the field of optical lenses, according to TSR predictions, Sunny Optics ranked first in the market share of optical lenses in 2020, further narrowing the gap with Taiwanese manufacturer Da Li Guang in ultra high end optical lenses. In the field of voice coil motors, TSR data shows that the top three manufacturers in the market in 2019 were Alps, TDK, and Sanmei Group, all of which are Japanese manufacturers. However, the market share of major domestic manufacturers Haoze Electronics and Zhonglan Electronics increased from 3.8% and 4.4% in 2017 to 10.5% and 9.5% in 2019, respectively. It is expected that their market share will further increase in 2020.

The application scenarios are becoming increasingly widespread

With the continuous commercialization of new generation technologies such as 5G communication, intelligent driving, and 3D sensing, the application scenarios of camera modules are also gradually increasing. The consumer electronics industry, such as smartphones, is a traditional application scenario for camera modules. Consumers' demand for high-quality and diversified shooting effects is driving the rapid development of mobile camera configuration and technology, as well as the continuous growth of the mobile camera market size.

Automotive electronics and the Internet of Things are becoming important application scenarios for camera modules. With the gradual popularization of intelligent driving and vehicle networking technology, smart cars have a broad market demand. As an important channel for obtaining driving information and providing communication methods, the number of cameras required for a single car will rapidly increase to meet the needs of autonomous driving and leisure entertainment. Therefore, the demand for in car cameras will continue to grow.

There are many application scenarios for the Internet of Things, such as smart homes, smart cities, smart agriculture, etc. Among them, camera modules, as important sensors for optical imaging, are mainly used in fields such as machine vision and high-definition video. For example, in smart homes such as floor cleaning robots and refrigerators, camera modules can perform functions such as 3D sensing and surrounding environment judgment. In smart robots such as drones, they can identify obstacles, take photos, etc.

The types of cameras are constantly enriching

With the diversification of consumer demand and the innovation of module manufacturers' technology, the functions and types of cameras are constantly enriching, such as optical stabilization, large aperture, 3D sensing cameras, periscope cameras, etc. The constantly updated and iterated cameras bring new consumer experiences to users. Optical stabilization uses lens shake to counteract hand shake, achieving clearer and more stable photography effects; A large aperture can obtain higher light flux, achieve effects such as background blurring, highlight the theme, and improve focusing speed; The periscope camera can significantly increase the focal length of the camera in a limited space, achieving better optical zoom; 3DSensing cameras can achieve real-time 3D information collection by interpreting 3D position and size information, thereby adding object perception functionality to consumer electronics terminals.

Optical image stabilization, large aperture, and periscope cameras achieve better shooting effects, while 3DSensing cameras break the boundaries of 2D to 3D, expand the application range of cameras, and improve user experience. In the future, in addition to the technological innovation of camera module manufacturers themselves, downstream customers such as mobile phone manufacturers and drone manufacturers will also accelerate the update speed of cameras to achieve differentiated competition and better user experience, continuously enriching the variety of cameras.

Vertical integration towards upstream raw material industry

Deepening the integration of the raw material industry upwards and achieving synergies will be an important means for camera module enterprises to expand their market size, improve their gross profit margin, and strengthen their competitive advantages. It is also the future development trend of module enterprises. At present, OFILM and Sunny Optics have penetrated deep into the field of optical lens production. By entering the upstream raw material industry and strengthening vertical industry integration, module enterprises will be able to grasp the direction of industry development, improve innovation capabilities, and comprehensively enhance market competitiveness.

Market concentration continues to increase

The camera module industry, as a capital and technology intensive industry, has significant economies of scale. Module manufacturers need to invest high capital in capacity building and product research and development in the early stages, which makes it difficult for small and medium-sized enterprises to afford; A stable high yield rate is the core competitiveness of module manufacturers. In the production process, module manufacturers need to continuously invest funds in process improvement to improve production efficiency and product yield rate. However, small and medium-sized enterprises generally have lower yield rates due to insufficient investment; At the same time, downstream smartphone customers are highly concentrated and have the characteristics of high demand and elasticity. Small and medium-sized module manufacturers are unable to deliver large quantities of high-quality camera modules in a timely manner, which cannot match the needs of downstream customers. On the other hand, large camera module manufacturers have strong production and order delivery capabilities, and are more likely to obtain orders from downstream customers; In addition, large camera module manufacturers have strong production capabilities and the ability to undertake flagship model orders with high precision requirements for camera modules, resulting in a continuous increase in market share for large module manufacturers.

At the same time, large module manufacturers will have the ability to invest more resources in developing new technologies and expanding camera module applications, further reducing production costs, improving profit levels, and continuously consolidating their leading position.

Major enterprises in the industry

OFILM

Covering the vast majority of mainstream mobile phone and car camera module product categories. Pioneering the mass production of structured light 3D Sensing modules and 3D ToF modules, successfully developing the industry's first ultra-thin periscope continuous zoom module, etc; The field of mobile phone cameras has become a major supplier of high-end dual camera modules and triple camera modules, with customers including major mobile phone brands; More than 20 domestic car manufacturers have obtained supplier qualifications in the field of in car cameras.

Sunny Optics

The mobile phone camera field can produce the vast majority of mid to high end camera modules. Mass production has been completed in the field of car cameras. The IoT camera field is mainly used for facial recognition and robotic vacuum cleaners. We have completed the research and development of a 10x optical zoom mobile phone camera module and an 8-megapixel front facing car module, as well as the development and promotion of second-generation semiconductor packaging solutions; The mobile phone camera field has become the main supplier of mid to high end camera modules, with customers covering major Android phone brands; The field of in car cameras has currently achieved mass production; IoT clients are currently under development.

Helitai

The mobile phone camera module has currently produced 64 million camera modules and is actively promoting the research and production of high-end products. At present, we have mass-produced 64 million pixel camera modules and continue to develop high-end camera products and technologies such as ToF3D cameras and 108 million pixel camera modules; We have established good cooperative relationships with customers such as Samsung, OPPO, vivo, Xiaomi, Transsion, Foxconn, BOE, etc.

Foxconn

We have produced high pixel mobile phone camera modules, 3DSensing camera modules, etc. The main customers are Apple brand and some Android phone brands.

Xinli International

We mainly produce low pixel mobile phone camera modules and car camera modules. The main customers are Android phone brands.

LGInnotek

We have produced high pixel mobile phone camera modules, 3DSensing camera modules, car camera modules, etc. The main customers are Apple brand and some Android phone brands.

Tongxingda

We mainly produce low pixel mobile phone camera modules, while expanding our product line to fields such as panoramic camera imaging modules and video conferencing imaging modules. We mainly have ODM customers for mobile phones such as Huaqin and Wentai Technology, as well as domestic mobile phone brand customers such as ZTE and Lenovo; We have customers in the fields of panoramic cameras and video conferencing systems.

Lianchuang Electronics

We mainly produce low pixel mobile phone camera modules and are currently continuously developing incremental core customers and non mobile phone industry brand customers. The cooperative brands include Huawei, Samsung, Wentai Technology, Huaqin, Transsion, etc.

Lijing Innovation

Successfully mass-produced mobile phone camera module, tablet camera module, laptop camera module, and successfully mass-produced triple camera mobile phone camera module.

Qiu Ti Micro

The product covers ultra-thin camera modules ranging from 2 million pixels to 108 million pixels, dual/multi camera modules, optical image stabilization (OIS) camera modules, 3D sensing camera modules, car camera modules, and IoT camera modules. Our clients include leading companies in various industries such as Huawei, Xiaomi, OPPO, vivo, Samsung, DJI, Ecovacs, Stone Technology, and Xiaotiancai. In addition, the company's car camera module products have also been delivered for use in models of brands such as SAIC GM Wuling, Geely Automobile, Xiaopeng Motors, SAIC Motor Passenger Cars, Lantu Automobile, and Foton Daimler. In addition, the company has also passed the qualification certification of qualified suppliers for multiple automotive companies such as BYD, Continental Automotive, NIO, BAIC New Energy, and Dongfeng Commercial Vehicle, and has successively obtained multiple cooperation projects with the aforementioned automotive companies, gradually entering mass production and delivery.